|

Prosticks Articles

蘋果日報 --- 十月二十二日

價格時間分布用途廣

乾坤燭的理論起源於價格 ? 時間或價格

? 成交量分布圖表,借鑑1980年

Peter Steidlymayer發明的四度空間分析法

? Market Profileâ 。

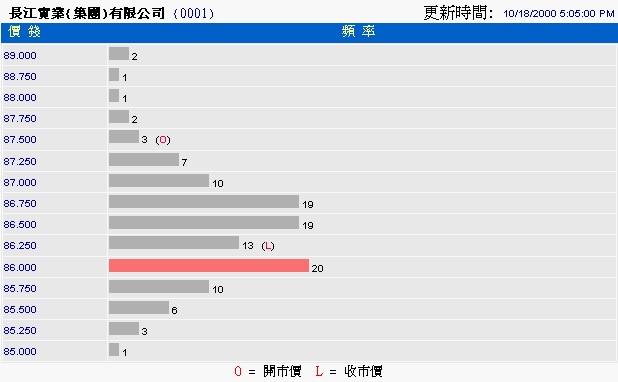

長實 (001) 18/10價格

時間分布圖

上圖是長實 (001)在10月18日的價格

? 時間分布圖,我們將整個交易日劃分

為每5分鐘一個單位,如10:00-10:05,10:05-10:10……等等。

假設在 10:00-10:05間,股價在87-87.5元範圍內變動,則在87、87.25和87.5處做

上「X」記號;在10:05-10:10間,股價是87.5-88元,則在87.5、87.75及88元處

做上「X」記號,餘此類推。要留意的是,我們每5分鐘只計算一次,假使87元在11:00-11:05期間出現3次,只會做一個「X」記號,而不是3個。數一數每個

價位有多少個「X」,即是該價位曾經在多少個以5分鐘劃分的時段中出現過,代表了該價位出現的頻密程度。

可察聚焦點活躍區

例如上圖中, 86元有20個「X」,即是說當天86元這個價位曾出現在20個5分鐘時段裏,市場花在這個價位的時間最多,我們定義86元這個價位為當日的聚焦點,聚焦量是20。大量的「X」出現在85.75-87元這個範圍內,這就是活躍區。

準確的活躍區是用統計學上的方程式計算出來的。

聚焦點有兩種計算方法:時間法及成交量法。上圖是價位與時間分布圖,如果想用成交量法來計算聚焦點及活躍區,可利用價位與成交量分布圖,其畫法和外形與上圖相同,不過將時間換為成交量。

長江實業(001)

|