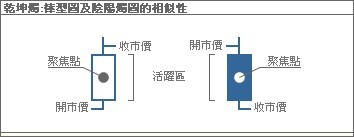

四度空間除了能顯示一般傳統技術分析之價位及時間外,還增加了兩項其他技術分析沒有的概念──人和事。以傳統技術分析和圖表技術所判斷的價位變動來比較,使用四度空間的理論,更能令投資者察覺到市場的潛能和力量。不過,四度空間欠缺一個簡明的圖表來闡述金融工具,所以要提升四度空間的概念來融入棒形圖/陰陽燭圖內,是一件知易難行的事。 乾坤燭發明的目的是企圖減低四度空間和其他技術分析圖表在功能上的限制。同時,提升成交量和時間的因素於傳統的技術分析和圖表內。 一般來說,乾坤燭的概念與四度空間相似,兩者皆由鐘形曲線理論而生。與傳統圖表不同,嶄新及直接的乾坤燭圖表提供重要和專業的市場資訊,強化你對金融工具的結構和理論之信心。 乾坤燭理論加入了時間和成交量,目的是減低在其他技術分析工具和圖表上產生的限制,所以乾坤燭分為兩種計算方法:以成交量計算和以時間計算。其概念將會在下文細述。   乾坤燭的外形與棒形圖和陰陽燭圖甚為相似,所以分析員絕不會對乾坤燭感到陌生。乾坤燭表達開高低收的方式與棒形圖無異,其燭身亦跟陰陽燭非常相似,同樣以白色代表低開高收;深色代表高開低收。但乾坤燭卻能提供更多的重要訊息反映市場動向,以下為乾坤燭獨有的數據: 乾坤燭的外形與棒形圖和陰陽燭圖甚為相似,所以分析員絕不會對乾坤燭感到陌生。乾坤燭表達開高低收的方式與棒形圖無異,其燭身亦跟陰陽燭非常相似,同樣以白色代表低開高收;深色代表高開低收。但乾坤燭卻能提供更多的重要訊息反映市場動向,以下為乾坤燭獨有的數據:

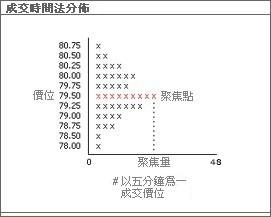

聚焦點──乾坤燭燭身中的圓點代表當日成交最多的價位。 有兩種方法計算聚焦點: 『成交量計算法』與『時間計算法』,約98%情況下,以此兩種方法計算所得之聚焦點為同一價位; 如遇特別市場活動,如批股等,則用時間計算法所得之聚焦點更能清晰反應市場行為。 以『時間法』計算出來的聚焦點:

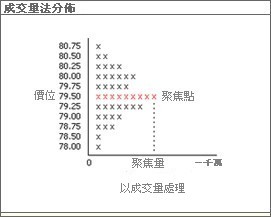

以某一交易日為例,由開市起計,每五分鐘為一基數(例:10:00-10:04, 10:05-10:09, 10:10-10:14, 如此類推)。港股每日開市由上午10時至下午4時,共48個基數(即4個交易小時x 12個基數)。 所有價位都以基數記錄下來,用作計算聚焦點。每一個價位的五分鐘基數,無論只有1個交易或千個交易,我們都只會採用1個基數為代表(如左圖的"X") 出現最多五分鐘基數的價位,即為當日的聚焦點(見上圖顯示之紅色位置)。 此計算方法用在沒有成交量的外匯市場,尤為合適。此方式更能有助避開大戶在短期內的大手操控和造價,以致開市及收市價大起大落。因此,乾坤燭比傳統的分析工具更能有效地揭穿假突破,助你避開陷阱。 以『成交量法』計算出來的聚焦點:   顧名思義,取自全日成交量最多的價位。只適用於附有成交量的金融產品。 顧名思義,取自全日成交量最多的價位。只適用於附有成交量的金融產品。

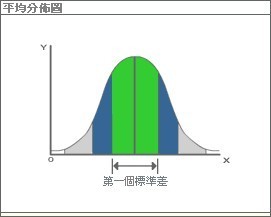

隨著聚焦點的開發,應運而生的還有聚焦量和聚焦成交量。聚焦量是以聚焦點(時間法)相對的基數數值;而聚焦成交量是聚焦點(成交量法)相對的成交量。兩者各有優勝之處,缺一不可。我們相信聚焦量和聚焦成交量可在芸芸的技術指標中,得到大家的認同。   活躍區是另一個乾坤燭獨有的數據。其特點與四度空間的價值區域相似,同樣由統計學上的正常分布衍生出來,利用電腦計算出位於中位數正負一個標準差的價格。簡單來說,活躍區代表著全日約68%的交投記錄(見附圖綠色位置)。 活躍區是另一個乾坤燭獨有的數據。其特點與四度空間的價值區域相似,同樣由統計學上的正常分布衍生出來,利用電腦計算出位於中位數正負一個標準差的價格。簡單來說,活躍區代表著全日約68%的交投記錄(見附圖綠色位置)。

利用活躍區作分析,每一個時段內的成交分布一目了然,有效看穿假突破,逃過大戶的操縱。 綜合以上各點,乾坤燭並不是要取代專業人仕常用的傳統技術分析和圖表工具,而是提升傳統技術工具(如陰陽燭、相對強弱指數、移動平均線等)的功能。 |